AURORA CANNABIS (ACB)·Q3 2026 Earnings Summary

Aurora Cannabis Beats Estimates, Goes All-In on Medical Cannabis

February 04, 2026 · by Fintool AI Agent

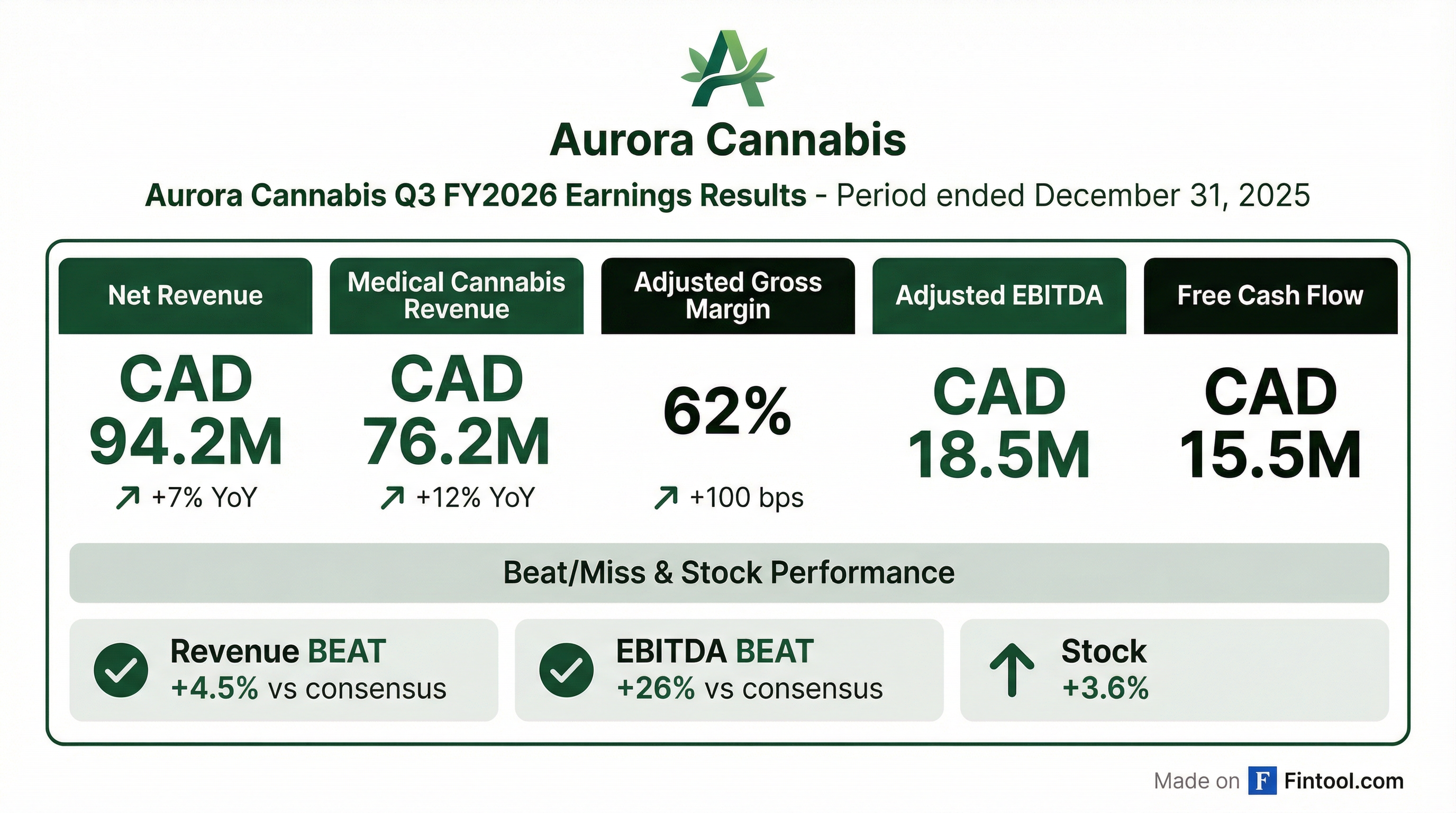

Aurora Cannabis delivered a double beat in Q3 FY2026, topping revenue and EBITDA estimates while announcing a transformational strategic pivot. The company is exiting Canadian consumer cannabis and divesting its Bevo plant propagation business to become a pure-play global medical cannabis company—a bet on the segment where Aurora commands 69% gross margins and leadership positions in Canada, Germany, Poland, and Australia.

The stock closed up 3.6% at $4.06 on the news, signaling investor approval of management's focus on profitable growth over revenue diversification.

Did Aurora Cannabis Beat Earnings?

Yes—comfortably. Aurora delivered a double beat on both revenue and EBITDA.

The outperformance was driven by record global medical cannabis revenue of CAD 76.2 million, up 12% year-over-year with international sales growing 17%. Medical cannabis now represents 81% of total revenue (up from 77% YoY) and 95% of adjusted gross profit.

This marks Aurora's continued streak of profitable quarters. The company generated CAD 15.5 million in positive free cash flow and ended with CAD 154 million in cash—completely debt-free on the cannabis side.

What Changed This Quarter?

Three major strategic announcements signal a fundamental shift in Aurora's business model:

1. Exiting Canadian Consumer Cannabis

Aurora will begin exiting select Canadian consumer cannabis markets, redirecting finite high-quality flower to higher-margin international medical markets. Consumer cannabis carried CAD 5.2 million in Q3 revenue (down 48% YoY) with only 28% gross margins—a far cry from medical's 69%.

CEO Miguel Martin left the door open to fully exiting consumer: "If that is a decision that looks like it's best suited to be exclusively on the medical cannabis side, it's something we would do."

2. Divesting Bevo Plant Propagation

Aurora is selling its controlling stake in Bevo to its other principal shareholders. Plant propagation generated CAD 11.3 million in Q3 revenue but only 16% gross margins (down from 40% YoY) due to inventory write-offs and rising costs.

3. $100 Million ATM for M&A

Aurora filed a new At-the-Market equity program for up to $100 million in common shares—to be used exclusively for strategic and accretive purposes including cultivation capacity expansion and M&A.

With over CAD 150 million in cash plus the ATM, Aurora is positioning to acquire assets in global medical cannabis—whether cultivation capacity, distribution networks, or clinic operations.

How Did the Stock React?

Aurora shares closed at $4.06, up 3.6% on earnings day—a clear endorsement of the strategic pivot.

The stock has traded in a range of $3.75-$6.91 over the past year and sits 9% below its 50-day moving average of $4.47. The market is rewarding Aurora's disciplined focus on profitability over growth-at-all-costs, a lesson many cannabis peers learned the hard way.

What Did Management Guide?

Aurora provided updated full-year FY2026 guidance, reinforcing confidence in medical cannabis momentum:

Notably, with year-to-date medical cannabis revenue at CAD 211 million through Q3, the guidance implies Q4 medical revenue of CAD 58-70 million—a step down from Q3's CAD 76.2 million. When pressed on this apparent deceleration, CFO Simona King acknowledged potential "headwinds in some markets" while emphasizing the full year remains a record.

Geographic Breakdown: Where Is Aurora Winning?

Aurora is a market leader in the three largest legal medical cannabis markets outside Canada:

Germany (Largest European Market)

- Primary driver of double-digit international growth

- Imports expected to more than double in 2025 (from 72 metric tons in 2024)

- Aurora doubling production at its Leuna facility

- Core and premium products insulated from value segment price pressure

- Regulatory uncertainty around potential Telehealth changes; Aurora confident it can adapt as it did in Poland

Australia (#2 Market Share)

- Largest international market for Aurora

- AUD 1 billion+ opportunity according to Penington Institute

- Transitioning from value-focused to premium products—causing near-term pressure

- Broadest product format range outside North America (flower, oil, edibles, vapes)

Poland (#1 Market Position)

- Market leader in calendar 2025

- Successfully navigated shift from Telehealth to clinic prescriptions

- Recently launched third proprietary cultivar

- Benefiting from increased annual import limits

Emerging Markets

Aurora is tracking new opportunities in Switzerland, Austria, France, Turkey, and Ukraine. CEO Martin noted: "We've been very successful...to be able to enter [markets] as they come online."

Key Management Quotes

On the strategic pivot:

"We are reallocating and directing our resources to focus primarily on the global medical cannabis market, where we excel and see runway for growth."

On premium positioning:

"Our sweet spot is the genetics, production, and delivery of core and premium medical cannabis products."

On M&A firepower:

"With over $150 million in cash, and then you add this [ATM], it really allows us to be opportunistic...cultivation, distribution, or clinic side."

On U.S. rescheduling:

"What the Trump administration announced is very consistent with what we've said is important. Medical cannabis first...we think that lines up beautifully for a company like Aurora."

What's the Bull Case?

- Industry-leading margins: 69% medical cannabis gross margins vs. 28% consumer—the pivot makes mathematical sense

- GMP moat widening: EU GMP certification requirements are getting stricter, limiting competition

- Geographic diversification: Leadership in 4 of the largest legal medical markets reduces single-market risk

- Balance sheet strength: CAD 154M cash, no cannabis debt, now with $100M ATM for opportunistic M&A

- U.S. optionality: Rescheduling could open the world's largest medical cannabis market to GMP-certified exporters like Aurora

What's the Bear Case?

- Q4 guidance implies deceleration: Medical revenue guidance suggests CAD 58-70M in Q4 vs. CAD 76.2M in Q3

- Australia transition risk: Premiumization strategy creating near-term sales pressure in #1 international market

- Regulatory uncertainty: Germany may modify Telehealth and home delivery frameworks

- Dilution risk: $100M ATM could pressure shares if used aggressively

- Competitive intensity: Value segment in Germany and Australia attracting new entrants

Financial Summary

Forward Catalysts

- Q4 FY2026 earnings (June 2026): First full quarter reflecting consumer cannabis exit

- Bevo divestiture closing: Expected in coming weeks; will simplify financial reporting

- Germany regulatory clarity: Government proposals on Telehealth expected by spring 2026

- M&A announcements: Management signaling openness to cultivation, distribution, or clinic acquisitions

- U.S. rescheduling details: Could unlock long-term market access for Canadian GMP producers

The Bottom Line

Aurora Cannabis delivered a clean beat and used the occasion to announce a strategic pivot that crystallizes its identity: a pure-play global medical cannabis company. By exiting lower-margin consumer cannabis and divesting Bevo, Aurora is betting that premium international medical cannabis—where it already commands 69% margins and leadership positions—offers the best path to sustainable profitability.

The math supports the thesis. Medical cannabis now drives 95% of gross profit. International markets are growing 17%+ annually. And Aurora's GMP certifications represent an increasingly valuable moat as regulatory standards tighten.

The risk is execution—particularly navigating Australia's premiumization transition and potential German regulatory changes. But with CAD 154 million in cash, no debt, and a fresh $100 million ATM, Aurora has the firepower to weather turbulence and capitalize on opportunities.

For investors seeking cannabis exposure with a focus on profitability over growth-at-all-costs, Aurora's Q3 results make the case that its decade-long bet on medical cannabis is paying off.

Data sourced from Aurora Cannabis Q3 FY2026 earnings call, company filings, and S&P Global.